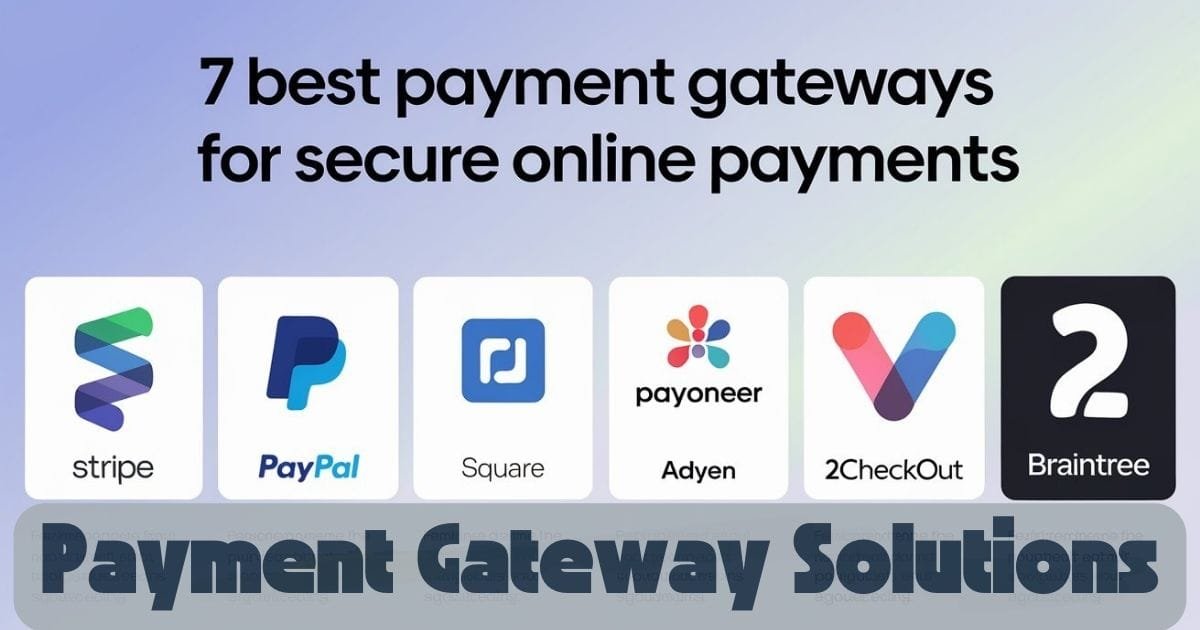

Top 7 Payment Gateway Providers

These secure online payment gateways offer great options for businesses selling goods online. However, each one has unique features. This guide will help you decide the best online payment solution for your business.

Stripe

Stripe is a fintech company offering payment processing solutions for both online and brick-and-mortar businesses. With Stripe, you can accept credit cards, debit cards, and mobile wallets from around the globe.

Stripe is particularly useful for developers, as it provides many customization tools to tailor the gateway payments to fit your business needs. It supports global payment solutions like Buy Now, Pay Later (BNPL) options and Klarna.

However, if you’re not tech-savvy, you may find its features challenging to maximize.

2.9% + 30¢ per successful card charge or payment link

0.8% per ACH direct debit (capped at $5)

BNPL (Klarna): Starts at 5.99% + 30¢

Tailoring the payment process to your business needs with custom options.

💡 You can link your Wise account with Stripe to receive money in multiple currencies without high fees—perfect for international businesses!

PayPal

PayPal is one of the best-known payment gateways. It’s user-friendly and straightforward to set up, making it ideal for new businesses.

A significant advantage of PayPal is its widespread use among businesses, but its fees can be tricky.

Fees vary depending on several factors. You can check PayPal’s fee structure with their fees calculator.

Easy setup and convenience for new business owners.

Square

Square is an easy-to-use payment gateway solution with software that allows you to accept gateway payments in-person and online. It’s a favourite among small business owners.

Setting up with Square is simple and has minimal startup costs. However, it might not be the best option for businesses needing more advanced global payment solutions.

No setup or monthly fees

2.9% + 30¢ per transaction

$0.50 per delivery order

Setting up online and in-store payments with no extra fees.

Payoneer

Payoneer is a platform used by companies like Airbnb and Google. It supports worldwide transactions in over 200 countries and 150 currencies, making it a strong global payment solution.

You can use Payoneer to send payment requests that customers can pay via credit card, ACH direct debit, or bank transfer. However, the fees can add up if you regularly receive payments from non-Payoneer users.

Free to set up and send/receive between PayPal accounts

3% fee for credit card payments from non-Payoneer users

1% for ACH direct debit

Receiving international transactions with ease.

Adyen

Adyen is a popular online payment solution for international businesses. It has no setup or monthly fees; you can choose the currency to settle transactions.

Adyen charges a fixed processing fee based on the payment method.

No setup or monthly fees

Fixed processing fee + a fee based on the payment method (e.g., ACH Direct Debit: $0.13 + $0.27)

Premium global payment processing.

Verifone (Previously 2Checkout)

Verifone is an online payment gateway solution that allows businesses to accept payments from over 200 countries. It provides various pricing plans, including the 2SELL tier, designed for online businesses.

However, there may be a problem if your business also requires better in-person sales solutions.

2SELL: 3.5% + $0.35 per sale

Cross-border fee: 2% on top of transaction fees

A free online payment gateway for businesses selling online only.

Braintree

Braintree, owned by PayPal, is a simple payment processing solution for in-store and online transactions. It supports the most popular payment methods with an easy-to-use interface.

While Braintree is straightforward, it needs advanced features, making it less suitable for businesses with complex payment needs.

No monthly fees

2.59% + $0.49 per card/digital wallet transaction

Additional 1% fee for cards issued outside the U.S.

Venmo: 3.49% + $0.49 per transaction

ACH Direct Debit: 0.75% per transaction

How Do Payment Gateways Work?

Payment gateways are services that allow businesses to accept credit card payments online. These gateways link the customer’s bank and the business’s payment platform, ensuring secure transactions.

You can think of payment gateways as virtual doors that simplify and secure the payment process.

What to Consider When Choosing a Payment Gateway

Save on International Payments with Wise

If your business handles international payments, consider Wise Business for sending and receiving funds. It’s designed for global companies and allows you to manage funds in over 40 currencies. You can also get local bank details in significant currencies to save on fees when receiving gateway payments from overseas.

👁 Post Views =72k

Welcome to IT Business Digest, your ultimate source for the latest information technology news and updates. Stay ahead with our in-depth coverage of emerging technologies, industry trends, and expert insights.